Education on investment is crucial for individuals for several compelling reasons:

1. Empowerment and Financial Independence: Investment education empowers individuals to take control of their financial future. By understanding the principles, concepts, and strategies of investing, people can make informed decisions and take proactive steps towards building wealth and achieving financial independence.

2. Making Informed Decisions: Investing without proper education can be risky and can lead to poor decision-making. Investment education equips individuals with the knowledge to evaluate investment options, assess risks, and understand potential returns. It helps them make well-informed decisions aligned with their financial goals and risk tolerance.

3. Maximizing Returns: Education enables individuals to identify investment opportunities that have the potential for higher returns. It teaches them to analyze market trends, conduct research, and identify undervalued assets. With the right knowledge, individuals can optimize their investment strategies and maximize their returns on investment.

4. Risk Management: Investing involves risks, and education helps individuals understand and manage those risks effectively. They learn about diversification, asset allocation, and risk management strategies. Educated investors can minimize the impact of market downturns and mitigate risks through a well-diversified portfolio.

5. Avoiding Investment Scams and Fraud: Investment education helps individuals recognize and avoid investment scams and fraudulent schemes. By understanding common red flags, conducting due diligence, and recognizing unrealistic promises, educated investors are less likely to fall victim to fraudulent activities.

6. Long-Term Financial Security: Investing is a long-term endeavor, and education helps individuals adopt a long-term perspective. It teaches them the importance of patience, discipline, and the power of compounding. By investing wisely and consistently over time, educated individuals can secure their financial future and enjoy a comfortable retirement.

7. Adapting to Changing Markets: Investment education is an ongoing process. It helps individuals stay updated with market trends, emerging investment opportunities, and regulatory changes. By continuously learning and adapting, individuals can navigate changing market conditions and adjust their investment strategies accordingly.

In summary, investment education provides individuals with the knowledge, skills, and confidence needed to make informed investment decisions. It empowers them to take control of their financial future, maximize returns, manage risks, and avoid common pitfalls. By investing in education, individuals can set themselves on a path to long-term financial success and security.

OUR Programs

First-Time Investor: Grow and Protect your Money

Guide for Young Investors

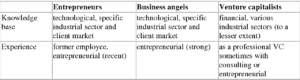

Investor Type and New-Venture Governance: Cognition vs. Interest Alignment

Creating Value. Value to investors

Behavioral Patterns and Pitfalls of U.S. Investors