Fixed income investments aim to generate consistent interest income, diversify your portfolio, preserve capital, and potentially offer tax advantages.

Why invest in fixed income?

Investing in fixed income can be a strategic move to accomplish various financial objectives. If you aim to diversify your investment portfolio, save for the future, secure a reliable income stream, preserve your principal amount, or minimize tax liabilities, fixed income investments present an attractive option. With their stable returns and potential for capital preservation, fixed income securities such as bonds offer a conservative and predictable investment avenue. By allocating a portion of your investment portfolio to fixed income, you can achieve a balanced and well-rounded approach to wealth management, ultimately working towards your desired financial outcomes.

Reflect on your objectives for fixed income investments and consider their alignment with your financial goals and risk tolerance.

Identify Financial Goals

Evaluate why you are considering fixed income investments, such as income generation, capital preservation, or funding specific financial milestones like retirement or education expenses.

Assess Risk Appetite

Determine your tolerance for risk and volatility, as different fixed income investments carry varying levels of risk. Consider factors like credit quality, interest rate sensitivity, and market fluctuations.

Time Horizon Considerations

Assess the timeframe for your investment objectives. Determine if you need immediate income, have a short-term goal, or are looking for long-term stability and growth.

Collaboration Diversification Strategy

Explore how fixed income investments can complement your existing portfolio. Evaluate the benefits of diversifying your holdings across different asset classes to manage risk and enhance overall portfolio performance.

Evaluate your unique investing style and preferences to align your investment strategies with your individual financial goals and risk tolerance.

Investment Approach

Consider your investing style, whether you prefer a conservative approach focused on capital preservation or a more aggressive strategy seeking higher returns with higher risk tolerance.

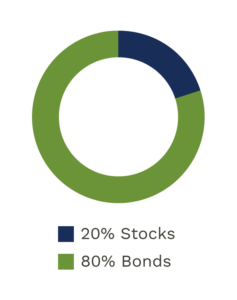

Asset Allocation

Evaluate how fixed income fits into your overall asset allocation strategy, balancing it with other asset classes like equities, cash, and alternative investments to achieve diversification and optimal risk-return trade-off.