Emphasis on assessing and managing risks to align with clients’ risk tolerance and objectives. Crystal Wave prioritizes risk management when it comes to ETF investing. We employ risk assessment techniques to ensure that ETFs selected align with our clients’ risk tolerance and investment objectives. Our focus is on preserving capital and achieving sustainable, long-term growth.

At Crystal Wave, we prioritize our clients’ needs and goals. We provide personalized service, taking the time to understand their unique circumstances and preferences. Our team is readily available to address any questions or concerns and offer ongoing support and guidance.

We actively monitor and manage our clients’ ETF portfolios. Our team stays abreast of market trends, industry developments, and macroeconomic factors to make timely adjustments to the portfolio allocations. This active management approach helps capitalize on market opportunities and mitigate potential risks.

Crystal Wave employs a strategic approach to asset allocation within ETF portfolios. We carefully analyze market conditions, economic factors, and client preferences to determine the optimal mix of ETFs across different asset classes. This strategy aims to enhance diversification and capture potential growth opportunities.

Our team possesses in-depth knowledge of various ETFs, including their underlying assets, investment strategies, and market dynamics. This expertise enables us to select ETFs that align with our clients’ investment goals and risk profiles.

ETFs are structured in a way that can provide tax advantages. Due to their unique creation and redemption process, ETFs can minimize capital gains distributions, resulting in potentially lower tax liabilities for investors.

Some ETFs distribute dividends or interest income generated from the underlying securities to shareholders. These distributions can be reinvested or taken as cash, depending on the investor’s preference.

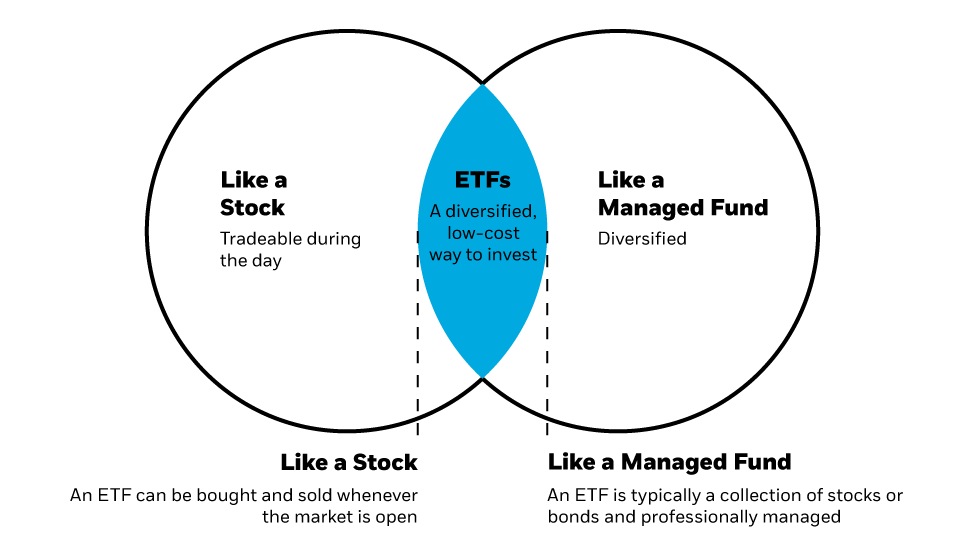

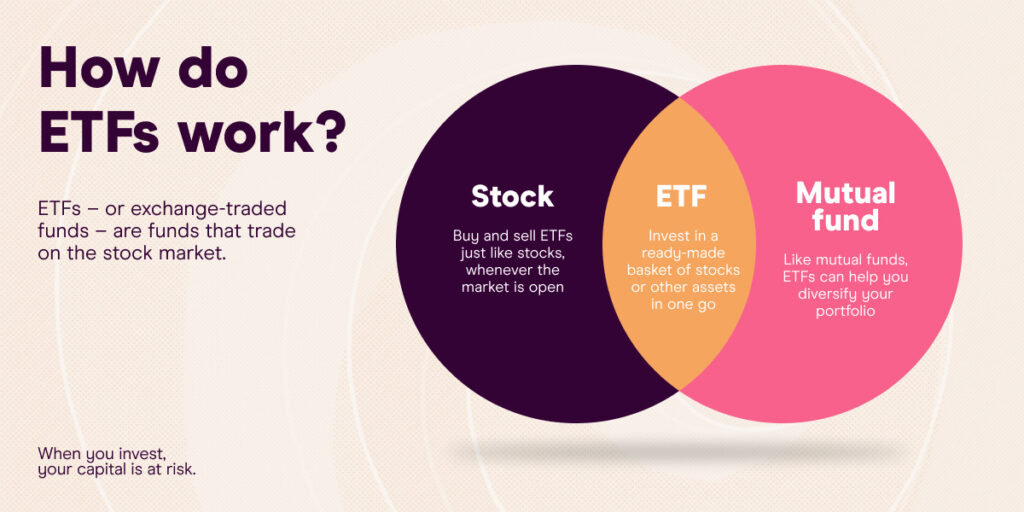

ETFs offer flexibility for investors. They can be bought and sold throughout the trading day at current market prices, providing liquidity. Additionally, investors can employ various trading strategies, including buying on margin, short selling, or placing limit orders.

ETFs often have lower expense ratios compared to actively managed mutual funds. This is because many ETFs passively track an index, reducing the need for active management and associated costs.

Many ETFs are designed to track the performance of a specific index, such as the S&P 500 or the NASDAQ. These ETFs aim to replicate the index’s performance by holding a similar portfolio of securities in the same proportion as the index components.

ETFs trade on exchanges, just like common stocks, allowing investors to buy and sell them during market hours.

ETFs trade like stocks, with prices fluctuating throughout the day, offering investors the flexibility to buy and sell at any time.

ETFs hold diversified portfolios of stocks, bonds, or securities, or focus on a single stock or bond through single-security ETFs.